Have you noticed these black-and-white square pictures at the stores? The ones with the puzzle appearance? That is a QR code. The payments in India are done using a special form of this code. It is called a UPI QR Code. You just scan it with your phone and that is it! It takes just a few seconds to pay money in the bank of the shopkeeper.

This system is referred to as UPI, that is, Unified Payments Interface. It is so super, super popular!

A few figures will show how large it is:

- Billions of Payments: Within a month (such as October 2025), more than 20 billion (that is 2,000 crore) Payments were made in India through UPI.

- Huge Value: The money that was transferred during that month alone amounted to over 27 lakh crore. That’s a massive amount!

- So Many Users: There are over 450 million (or 45 crore) users of UPI in India paying their day-to-day bills.

- Millions of Shops: More than 500 million (or 50 crore) traders, large supermarkets to small tea stalls, accept payments using UPI QR code.

Due to the popularity of UPI, a QR code is required by every company, large or small. But how do they get one? They acquire it through a UPI QR Code Generator.

This paper will inform you about these so-called generators and will mention the top 10 best UPI QR Code Generators in India.

What is the UPI QR Code Generator?

A UPI QR Code Generator is an application that allows users to create a UPI QR code using the app.

Let’s break down the name.

Generator A generator is one that produces or manufactures something.

- QR Code: QR code is an abbreviation that translates to Quick Response. It is a picture that can be read at a high speed by the phones.

- UPI: This is the payment system of India that is going to connect your bank account with your phone.

A UPI QR Code Generator is therefore a tool, an application or a business that creates a special QR code specifically to you or your business.

Once you register with either of these generators (such as the Paytm or the PhonePe application), you provide your bank account information. The application then creates a distinctive QR-code on your behalf. Such a code is associated with your account.

Once a customer scans this code, his phone is well aware where to send the money. It is a secret, special message to your bank account, a message that is concealed within that square image.

Benefits of Using a UPI QR code generator

Why do all the shopkeepers, sabzi-wala (vegetable sellers) in the large mall have a QR code? There are numerous advantages, which is why.

- It is Light Speedy: Customers swipe and get PIN and pay. It takes less than 10 seconds. One does not have to count money or wait to get change.

- It is so Easy: You do not have to type a long bank account number or IFSC code. You also do not have to type the phone number of the person. Just scan and pay. The customer and the shopkeeper can do it easily.

- It (Mostly) is Free: In the case of most small shopkeepers, the acquisition of a QR code is free. The apps do not impose any fee in order to create the QR sticker on their behalf.

- Money Goes Straight to the Bank: Once a customer makes payment to you, the payment goes straight to your bank account. It is not stuck in a “wallet.” This is very safe.

- It is safe and secure: You do not need to provide the customer with your bank details or phone number. The QR code makes everything work without transferring your personal information.

- Compatible with All Apps: That is the best thing. A phone pe QR code can belong to a shopkeeper. It can be scanned by a customer using Google Pay app. It can also be scanned by another customer that uses the Paytm app. It just works! This is referred to as interoperability.

Types of UPI QR Code Generators

These generators can create two major types of QR codes. One should understand the difference.

1. Static QR Codes

An unchanging and never-changing code is called a static code.

- What it is: It is the simple QR code sticker that can be found at the majority of small shops, stuck on the wall or on a small stand.

- The way it works: A customer scans this code. The UPI application in their phone requests them how much money they would like to transfer. The customer then has to input the amount (such as ₹50) by himself or herself.

- Most suited: Small malls, tea vendors, and auto-rickshaw cart drivers and to transfer money to friends.

- Case in point: You scan a QR code on your friend. The amount is required by your phone. You enter 100 INR and you share your lunch.

2. Dynamic QR Codes

A dynamic code is a new code and that is changing each time the payment is made.

- What it is: You do not find this on a sticker. You view it on a computer screen, a bill or a special POS (Point of Sale) machine.

- How it works: The shopkeeper enters the amount in his/her machine first. For example, your bill is ₹520. The shopkeeper enters 520 in his or her app or machine. Then the machine produces another QR code that is specific to this payment only.

Top 10 UPI QR Code Generators in India (In Detail)

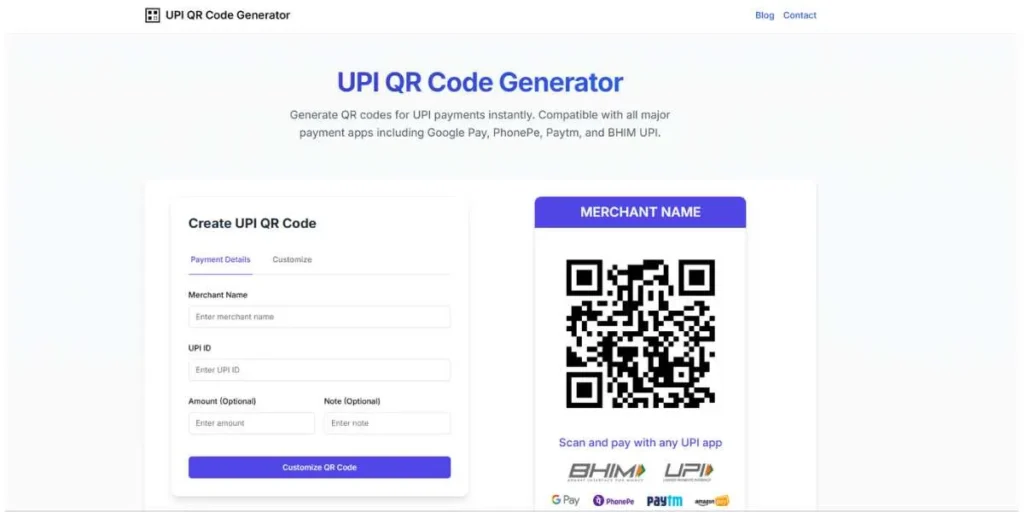

1. Upiqrcode.in

It is a free open-source JavaScript library that is used by developers. It provides you with the code (licensed under GPL v3) in such a way that you are able to create your own UPI QR code generators within your application or web page. The most important point is that it corrects the QR codes in the browser of the user, and thus, the UPI ID and the amount never leave the device.

Key Features:

- The JavaScript library is open-source.

- 100 percent processing occurs on the browser to enhance a higher level of privacy.

- Built to facilitate the development of tools by developers.

RBI/NPCI Compliance: Adheres to the NPCI regulations of UPI links, but is not certified. It is open source and allows the user to review the code.

Website: https:upiqrcode.in/

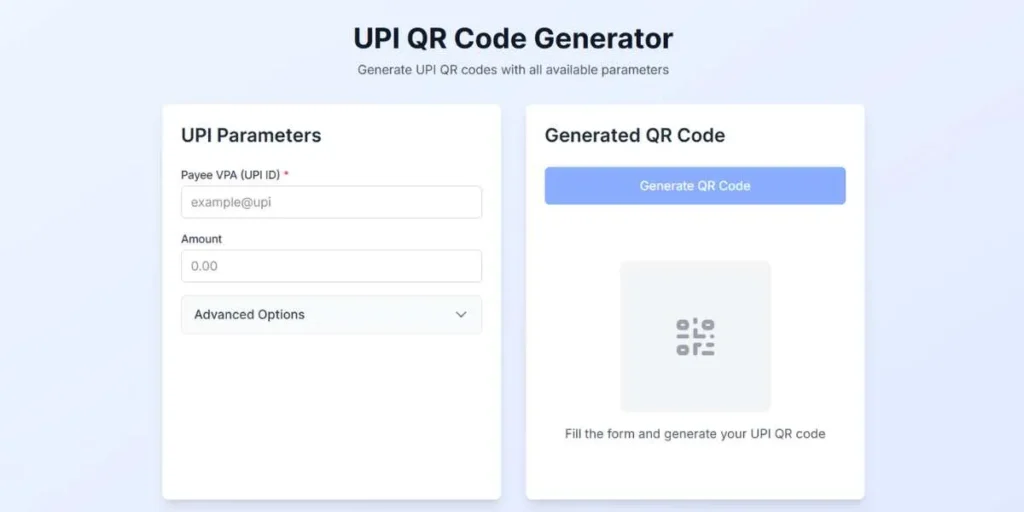

2. Labnol UPI QR Code Generator (labnol.org/upi)

This is a free web based tool that allows you to generate simple UPI QR without the need of registration. This is a one-page page and all you do is key in your UPI ID, the name of the payee, a specified amount and a brief note. Once you have clicked on the Generate button you are presented with a QR code that you can download as an image.

Key Features:

- Simple one‑page interface.

- No log (or) registration required.

- Allows you to establish a set price and note.

- It produces a non-dynamic QR code that can be downloaded instantly.

RBI/NPCI Compliance: It is also based on the NPCI standard, but not officially approved by NPCI and RBI. The site does not include any details regarding data security or privacy.

Website.https://www.labnol.org/upi

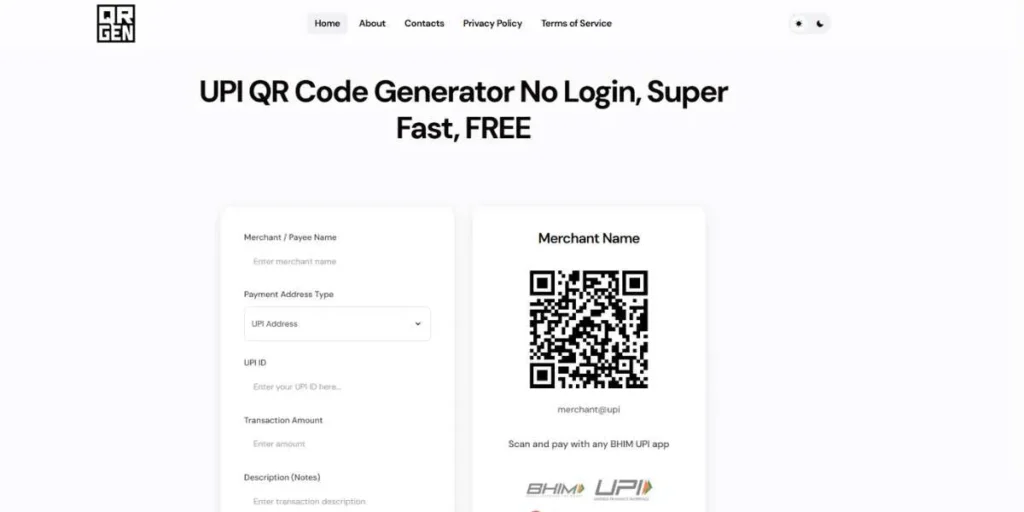

3. QR GEN (upiqrcodegen.com)

This is an open-source tool that purports to be quick, easy, and privacy-conscious in creating UPI QR codes that are not dynamic. It has a neat design and has no advertisements, and you do not have to register. According to the tool, all the data is handled in your browser and therefore your information is not transmitted or stored on its servers.

Key Features:

- Privacy oriented: all the actions are local and in-Browser.

- 100 % free and no ads.

- No login or signup required.

- Has the capability of generating codes using a UPI ID or using a bank account and IFSC.

RBI/NPCI Compliance: It is based on the NPCI standard, but uncertified. It has a good security advantage in local processing.

Website: upiqrcodegen.com.

4. Swapcode UPI Swapcode Generator (swapcode.ai)

It is a professional and AI-driven QR code platform that is not a mere UPI tool. It is concerned with the development of custom and branded QR codes in marketing. You are able to add logos, change colors, apply patterns and even design artistic QR codes which become part of the images.

Key Features:

- QR design by artificial intelligence.

- A great deal of customization: colors, shapes, logo location.

- Favors numerous types of QRs (URL, Wi-Fi, vCard, UPI, etc.).

- Provides scan tracking and analytics of dynamic QR codes.

RBI/NPCI Compliance: It is not a specialized financial instrument and is not NPCI certified. It claims to abide by GDPR regulations, which are European privacy regulations, but not RBI regulations.

Website: https://swapcode.ai

5. Generate My QR (generatemyqr.com)

It is an open source utility used to generate plain, merchant like UPI QRs. The user finds it easy to use: s/he puts in UPI ID, the name of the merchant or payee, a fixed amount, should they want it, and a note to the transaction. The QR code generated appears like the ones you find in a store and displays the name in a clear manner. The site can claim to be NPCI-compliant, but this is a typical and deceptive statement.

Key Features:

- Generates non-stop merchant type QR codes.

- Allows you to establish a given amount and transaction mark.

- Simple, free web interface.

RBI/NPCI Compliance: The site can state that it is compliant, and there is no certification. It constructs codes with the standard public NPCI thus should be used cautiously.

Website: https://generatemyqr.com.

6. The Scrippter Chart API (chart.scrippter.com)

It is an online charting tool designed for use by computer programmers and web developers. Scrippter Chart API (chart.scrippter.com) is an online charting tool, aimed at computer programmers and web developers. It is not a public site, but a technical API service to developers. It allows the programmer to create charts and images, such as QR codes, by transmitting information in a URL.

Key Features:

- API only to be used programmatically in applications and websites.

- Creates QR codes by accepting data (e.g. UPI string) in the form of a URL parameter.

- Can be customized (size, color, error correction) using the API.

- Not specific to UPI.

RBI/NPCI Compliance: The tool is not NPCI certified. Security and compliance are the tasks of developers in the course of its use.

Website: chart.scrippter.com.

7. api club UPI QR Code Generator (apiclub.in).

It is a paid business to business platform which provides API services to companies. It is not a free open source QR code generator. The biggest service is a UPI Validation API which allows merchants to approve a customer UPI ID (VPA) and receive the name of the beneficiary prior to payment.

Key Features:

- B2B API service to business is not a free tool.

- UPI ID validation: verifies in real time with the status and name of the beneficiary of the VPA.

- Developed to be inserted in payment systems to reduce fraud and failures.

RBI/ NPCI Compliance: Being a commercial API to financial services, it has greater security and reliability measures that are in line with the regulations of the ecosystem.

Website: https:.apiclub.in.

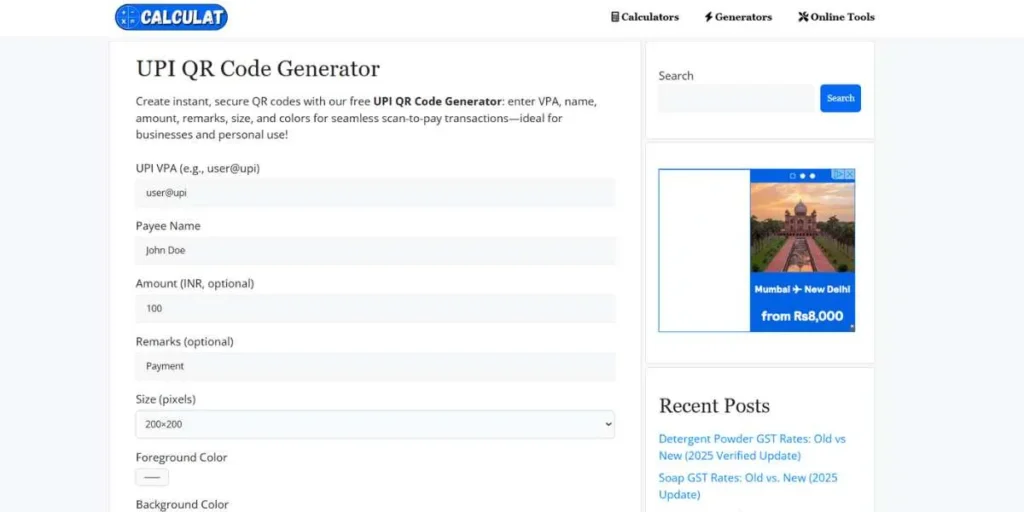

8. Calculat UPI Generator (calculat.co.in)

This is a free tool and constitutes a bigger site that provides numerous financial calculators. The UPI QR generator allows one to input a UPI ID, payee name, optional amount, and remarks. It is among the best UPI QR Code Generators.

Key Features:

- An element of a set of free online financial calculators.

- Easy interface on UPI ID, name, amount and remarks.

- Gives you a chance to change colour and size.

RBI/NPCI Compliance: No data on security or compliance. It establishes codes with reference to the NPCI standard.

Website: calculat.co.in/upi-qr-generator.

9. HSPS UPI QR Generator (upi-qr.hsps.in)

It is not an easy-to-use free personal tool. It appears to be a demo page of a professional payment service, maybe of an aggregator such as Juspay. It is supposed to be embedded by merchants in their websites or applications to do UPI payments.

Key Features:

- Not a personal tool but a business/merchant one.

- Designed to be integrated on the web and assist merchants to be paid through UPI.

- Probably offers QR codes and transaction analytics that are dynamic to merchants.

RBI/NPCI Compliance: In case of being included in a larger aggregators suite, it would be compliant with the RBI/NPCI of that company, which is safe and audited.

Website: https://upi-qr.hsps.in.

10. ABCStore UPI QR Generator (abcstore.in)

It is a free, easy web application that generates simple UPI QR codes in a non-interactive state. It belongs to a free set of tools called ABC Store that contains unrelated utilities such as a SIP calculator and a rent receipt maker. The QR generator is free and has basic interface of UPI ID and amount.

Key Features:

- No sign‑up or login needed.

- Comprising a bigger bundle of free financial tools.

- Allows you to customize style, color and logo.

- Download as PNG or PDF.

RBI/NPCI Compliance No particular compliance or security data. It generates codes with the help of the public NPCI standard.

Website: httpsfor://abcstore.in/tools/upi-qr-generator

RBI Approved UPI QR Code Generators

1. PhonePe for Business

- Ideal/Target Users: It can be used in any shop, small store, or large restaurant. It is the most popular choice.

The leader of UPI payment in India is PhonePe. Their PhonePe for Business application is designed specifically for shopkeepers. By registering, you receive a free green and purple QR code sticker. This QR can be scanned by the customers with any UPI app. The business application is highly easy to navigate. It displays all your payments at a single place. A PhonePe Soundbox is also available. It is a mini speaker that is audible when you receive money saying “PhonePe par 100 mil gaye.” In this manner you will not have to use your phone to make each payment. The cash gets into your bank account fast.

Key Features:

- Receive all UPI payments.

- Immediate confirmation of payments.

- Supplies Soundbox (speaker) to give auditory notifications.

- Simple app to track all sales.

- Money is paid within a short time either immediately or via the following day.

RBI/NPCI Compliance: Yes, it complies with all RBI and NPCI regulations.

Company Site: PhonePe on Play Store Business.

2. Google Pay for Business

- Ideal/ Target Users: Ideal in small and medium sized shops with a need to have a simple and trusted solution.

Everyone has trust in Google. Google Pay for Business is a special app that Google offers merchants. It is quite neat and convenient. Signing up is very fast. After you are accepted, you may receive your QR code immediately or request a free sticker. Similar to any other application, the QR code is compatible with every UPI application. There is also a Soundpod that is available at Google Pay. It is their variant of the soundbox, which proclaims payments. The application is also useful to monitor your daily sales and check the performance of your business. It is quite safe and easy and this is what a lot of shop owners would like.

Key Features:

- Simple and clean interface.

- Supported by security and trust of Google.

- Supplies a Soundpod as a sound alert.

- Simple process of establishing new businesses.

- Good sales tracking reports.

RBI/NPCI Compliance: Yes, it is in line with all the RBI and NPCI regulations.

Official Webpage: Google Pay for Business App on Play Store.

3. Paytm for Business

- Ideal Use/Target Users: This can be used by every kind of business whether it is a new start-up or a small shop or even a large online store.

Paytm is one of the oldest and the most popular payment apps in India. Their Paytm Business application is a strong one. It does not just provide you with a QR code. It is an all-inclusive business solution. Paytm provides you with the well known blue QR code sticker. They were the company which made the Soundbox popular. Their orator is the most popular. The business application also allows sending payment links to buyers. You may also take a business loan or acquire a Paytm Card Swipe machine. This renders it an excellent one-stop solution to an expanding company.

Key Features:

- High customer trust and a very strong brand.

- The oldest and most known Soundbox.

- One-stop application: Acquire loans, card machines, and payment links.

- Accepts Payments using UPI, Paytm Wallet, and cards.

- Online website integration is well supported.

RBI/NPCI Compliance: Yes, it is compliant with all the RBI and NPCI requirements.

Official Source: Paytm for Business App on Play Store.

4. BharatPe

- Ideal Use/Target Users: Any merchant and shopkeeper interested in a no-fee, simple service.

BharatPe gained popularity by providing one thing which is one QR code across all apps. Their promotion was quite high. They assured traders that they would zero the fee paid on all UPI transactions. This made them very popular. They have designed a special interoperable QR that is compatible with all apps. Shopkeepers also receive other services provided by them. You are able to obtain a BharatPe Swipe machine that will accept card payment. They provide small business loans as well. They only have an app targeted at the merchant and not to ordinary customers. This renders their application extremely easy to understand and helpful to the shop owners.

Key Features:

- A single QR code with all apps (Google Pay, PhonePe, Paytm, etc.).

- Strong promise of 0% fees on UPI.

- Provides business loans and credit cards swipes.

- Supplies a Soundbox to give audio alerts.

- Easy-to-use merchant-only app.

RBI/NPCI Compliance: Yes, it is in compliance with all the RBI and NPCI rules.

Official Source: BharatPe for Business App on Play Store is the official app of the company.

5. BHIM App

- Ideal Users/Target Users: The personal use, freelancers, and extremely small shopkeepers who require a fundamental, safe QR code.

The official UPI application developed by NPCI is BHIM (Bharat Interface for Money). UPI was developed by NPCI, which is a government-sponsored company. This is then the oldest, simplest and safest UPI application. It is not a business application as the rest are. It is a payment application that is easy to use by all. Nevertheless, their My QR can be located in the app by any user. You may print this QR code and put it at your shop. It is not accompanied by Soundbox or business loans. The primary advantage of it is that it is easy to use and highly trustworthy that it is the official government application.

Key Features:

- NPCI (creators of UPI) has an official application.

- Very simple, secure, and no ads.

- creates a personal static QR code.

- It is published in numerous Indian languages.

- The government directly supported it.

RBI/NPCI Compliance: Yes. This application is the compliance standard.

Official Link: BHIM App on Play Store

6. Razorpay

- Ideal Users/Target Users: Internet companies, web sites, e-commerce shops and application developers.

Razorpay does not seem to be comparable to PhonePe or Paytm. It is a payment gateway. This implies that it is designed to suit companies that get payments via the Internet. Razorpay is one of the best options in case you have a website or an app and wish to sell things. It is easy to add a Pay Now button to your site with them. They also create dynamic QR codes as a part of service. QR code can be displayed on your website when a customer on a computer wants to pay. The customer scans it by his phone and payment is completed. They are not the most appropriate towards a physical Kirana store, however, they are one of the most appropriate towards an online store.

Key Features:

- Ideal in web sites and internet stores.

- Dynamically creates desktop payment QR codes.

- Accepts credit cards, debit cards as well as net banking.

- Extremely simple to developers.

- Gives a high-powered dashboard to view all sales.

RBI / NPCI Compliance: Yes, it is a full licensed and compliant payment gateway.

Web Address: razorpay.com.

Step-by-Step Guide to Generate UPI QR Codes

It is not that difficult to create your own QR code. Here are the simple steps.

To get money, friends, and personal Use.

- Open your preferred UPI application (such as BHIM, Google Pay or PhonePe).

- Go to your Profile. It is normally an image of you or your first at the top-right.

- Tap on your profile. You will find such an option as My QR or UPI QR Code.

- Tap it. On the screen will appear your personal QR code.

- There is an option to take a screenshot or share it with a friend on WhatsApp via the “Share” button.

To put in your shop (To business use)

- Download a “Business” app. The example of this is PhonePe for Business or Paytm for Business.

- Start the application and register as a merchant.

- You will be required to provide information such as your business name, your bank account number and your IFSC code.

- The application will authenticate your information. This could be a couple of minutes or a couple of hours.

- After passing the test, you are good to go with your business QR code!

- You can get the QR picture or press a button in the app to get a free QR sticker in your shop.

Uses of UPI QR Codes

Where do we use these codes? The answer is… everywhere!

- Retail Shops: shopping of groceries, milk, clothes and medicine.

- In Food Stalls: buying tea, samosas, juice or paani-puri.

- In Transport: Paying taxi drivers and auto-rickshaw drivers.

- in Restaurants: Paying after eating.

- Paying Bills: Scan a QR code on your electricity/water bill.

- Online Shopping: Paying with a QR code on your computer monitor.

- Splitting a lunch bill or a friend with a friend.

- Donations: QR codes are now used to make donations by many temples, charities and even street performers.

Security and Limitations

UPI is extremely safe though you should be cautious. These are the most significant rules.

How to Be Safe (Best Practices)

- NEVER Post Your PIN: Your 4 or 6-digit UPI PIN is a secret. It is as though the key to your bank locker. The bank, Google or the phonepe will never call you and request it. Do not tell it to anyone.

- All you need to send money is a PIN: It is the most significant rule. Money does not require any PIN to receive money. When a person sends you a payment request and requests you to insert your PIN to get the money, it is a SCAM. They are attempting to rob you of money.

- Name Before You Pay: Once you have scanned a QR code, the name of the shop or the person will appear in your app. Always check this name. Before you enter your PIN, ensure that it is the correct shop.

- Check Fake Stickers: Fraudsters even stick a QR sticker with a fake one on top of an actual one belonging to a shop. When a QR code appears weird or it is pasted carelessly, then be cautious.

Limitation(What to remember)

- You Need Internet: This requires the customer and the shopkeeper to have a working internet connection (mobile data or Wi-Fi) to make the payment occur.

- Bank Limits: You have no limit on the amount of money you can send. Your bank sets a limit. To the majority, this cap is approximately 1 lakh a day.

- Bank Server Issues: In some cases, your payment may not get through or may hang. This is not most of the times your fault. This is because the computer of the bank (its server) is overworked. Waiting a couple of minutes and re-attempting it is the best action.

Conclusion

UPI QR codes have really transformed the Indian payment methodology. They have simplified life to millions of customers and shopkeepers. They are quick, secure and convenient.

These are the so-called generators, such as PhonePe, Google Pay, Paytm, and BharatPe, which have succeeded in placing this power in every street corner. They aided in making small businesses go online.

You may be a large company or a small stand but a UPI QR code is a necessity. It makes it easy to get payments and expand your business. You should just keep in mind that you should always be safe, keep your PIN and have the magic of instant payments!

Suggested Read: Best Proxy Servers for Secure and Anonymous Browsing

FAQs

Are UPI QR codes free?

Yes, in the case of the majority of personal and small business applications, acquiring a sticker of a fixed UPI QR code is totally free.

Is it possible to scan Paytm QR code using my PhonePe application?

Yes! That is the best part. Any UPI app (e.g., Google Pay, BHIM, etc.) can be used to scan any other UPI QR code (e.g., Paytm or PhonePe).

What is a fixed QR and a dynamic QR?

A fixed QR is a sticker, which does not vary (you type the amount). Dynamic QR An individual payment has a new code on the screen (amount is predetermined).

What happens to be the most valuable security tip?

You should not share your secret UPI PIN with anybody. All you have to do is send money using a PIN, but never accept money.